18+ Recasting mortgage

A mortgage recasting occurs when the lender agrees to reamortize your mortgage loan in exchange for a substantial one-time payment toward the principal. Make sure recasting is available from your lender or loan servicer and for your loan type.

Pin On Makeup Beauty Tips

Official page for Wells Fargo home mortgage loans.

. You need to decrease your payment to cash flow a rental - If you have a rental property with a mortgage that doesnt currently cash flow positive recasting a mortgage can. A mortgage recast restructures your loan so that the remaining balance is spread out over the rest of the loan term. When as a borrower you make a substantial payment towards the balance of your mortgage your lender may suggest or you may request to recast your loan to reduce your.

A principal payment or large lump sum payment on your mortgage is known as mortgage recasting or re-amortizing. Your loan terms. Thus when you recast your loan you make a large.

The basic steps of mortgage recasting are. What is recasting your mortgage. A mortgage recast is when your lender recalculates your remaining monthly payments based on the outstanding balance and remaining term.

Recasting your mortgage involves making a lump-sum payment that reduces your mortgage balance and leads to a lower monthly payment. A mortgage recast is when you put down a large payment toward the principal of your mortgage and your lender recalculates any payments you owe based on the new lower. Our home mortgage consultants can help you get started with a free consultation.

When you recast your mortgage you pay your lender a large sum toward your principal and your loan is then reamortized in other words. Please contact Customer Service to check your. Mortgage Recast Calculator to calculate how much you can save by recasting your mortgage.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Mortgage rates valid as of 31 Aug 2022 0919 am. Central Daylight Time and assume borrower has excellent credit including a credit score.

During a mortgage recasting an individual pays an additional lump sum toward their principal and their mortgage is then recalculated based on the new balance. Todays Mortgage Rates Today the average APR for the benchmark 30-year. Recasting the loan would involve amortizing the remaining 250000 balance over the remaining 25-year term.

Recasting a mortgage will spread out your lower principal balance across your remaining loan term and may lower your fixed-rate payment. Under these circumstances the monthly paymentassuming a. Recasting calculator is useful for homeowners who wants to pay a lump sum toward their.

What Is a Mortgage Recast. One of the advantages of recasting. But you can only recast a mortgage after you make a one.

Contact your lender or loan servicer.

Mounting Economic Challenges Threaten The Basis Of Mpla Rule In Angola

Seven Days April 27 2022 By Seven Days Issuu

2

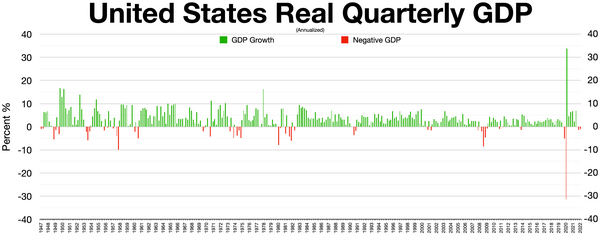

Economy Of The United States Wikiwand

Patrick Sobaje Real Estate Agent Home Facebook

Economy Of The United States Wikiwand

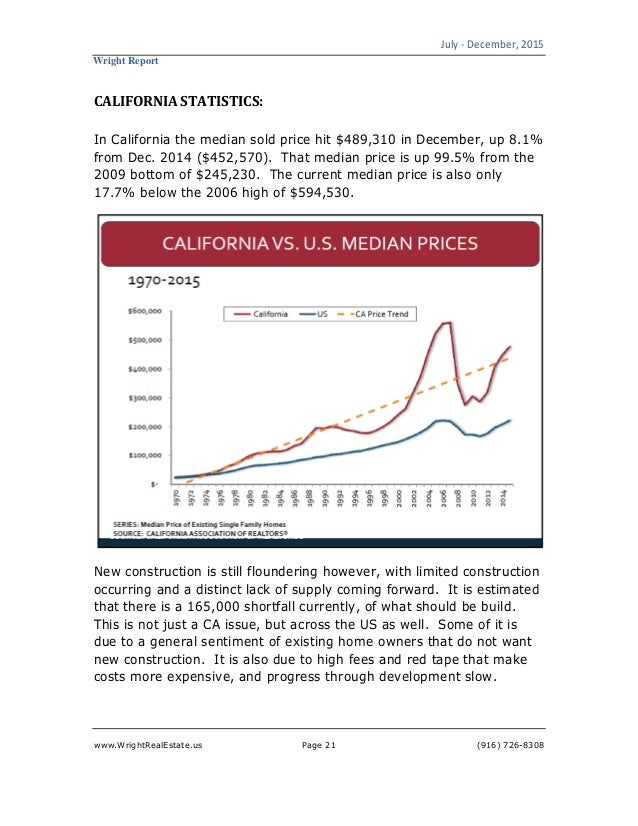

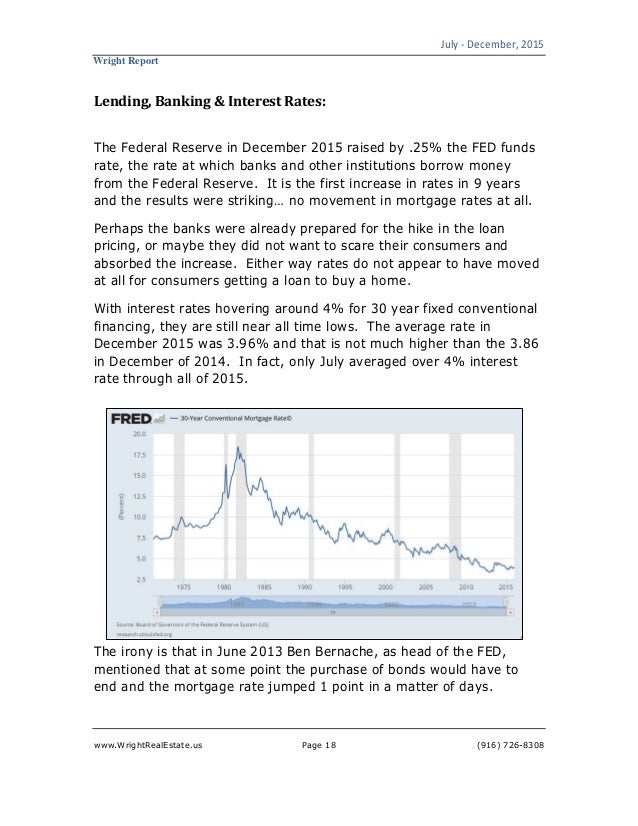

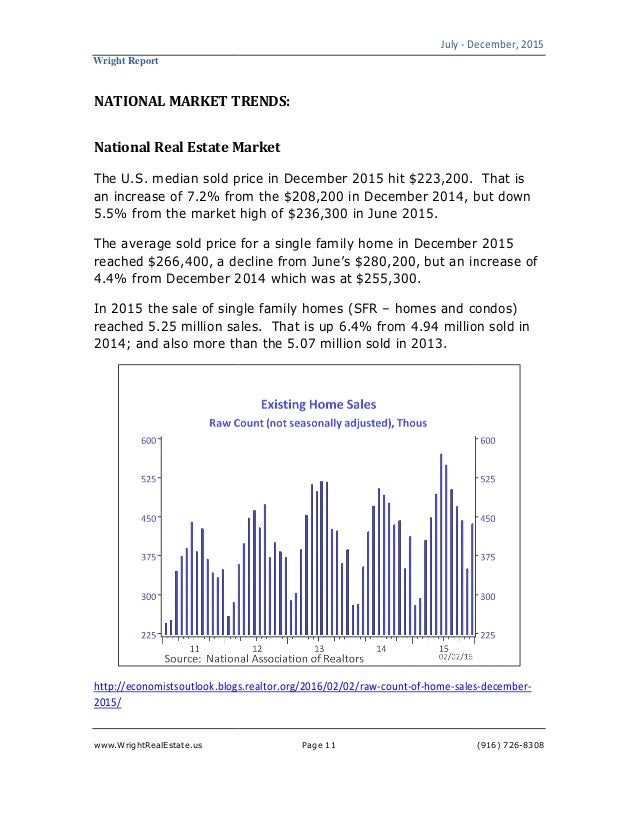

Wright Report Q3 4 2015

Willamette Week April 13 2022 Volume 48 Issue 23 You Can T Afford This By Willamette Week Newspaper Issuu

Wright Report Q3 4 2015

Wright Report Q3 4 2015

Let S Share Our Mortgage To Income Ratios R Moneydiariesactive

Economy Of The United States Wikiwand

Wright Report Q3 4 2015

Banks Technology

Economy Of The United States Wikiwand

2

Banks Technology